Neobanks vs Traditional Banks: how neobanks build the future of the financial system in the world

The rapid growth and development in technology have led to a new digital era. Just as quantum theory questioned stereotypical notions of physics and challenged common ideas around concepts of reality, neobanks are doing something similar to the banking system. Digital banking is no longer a theory; it has evolved to become a part of our daily life [1].

In this context, the traditional banking system is getting new challenges from digital banks (the latter call themselves precisely like that: challenging banks) day by day as they recreate customer experience of using banking services, creating new possibilities. New or neo banks are modern interpretations of the banking system. In contrast to traditional banks which can also offer online services but rely on their physical branches as a rule, neobanks are only digital financial institutions. Taking into account the increasing influence of neobanks in the financial market, they are also assumed to change consumers’ perceptions of financial services and lead to important trends in the market, particularly to financial involvement and increase of digital preference for branches. However, the market is quite competitive and contains many obstacles for the neobanks, too.

This work aims to find out whether the traditional banking system is strong enough to resist the competition with neobanks, which one of them will dominate in the future whether having a fully digital banking system is realistic in the near future, as well as what kind of influence e neobanks may have on the international financial system.

Neobanks vs Traditional Banks

FinTech Startups are disrupting the existing products and services with a focus on user experience, extracting value from data, decreasing operation costs, and increasing efficiency with their business models through advanced technology (Chappuis Halder, 2015) [2].

As fintech startups, neobanks offer banking services at a completely different level – with the logic of the digital revolution. This means that anyone who wants to use their services does not need to visit a bank branch or fill out paper documents. Each process is 100% digitized, and everything can be done through the bank’s website or mobile application. This means that the investments in the physical branch are aimed at improving online services, artificial intelligence, and its risk assessment tools.

Neobanks are presented in several forms:

- Neobanks with a banking license. These types of neobanks acquire a license for banking activity from the Central Bank or the corresponding authority. Among them are: “Atom” bank, “Revolut” in Great Britain and “N26” in Europe. These banks single out one to three main services that can be offered to customers, putting stress on their quality and convenience. For example, Revolut mainly attracts by issuing credit cards with interesting currency exchange offers [3].

- Neobanks collaborating with a licensed bank. This is a relatively easy way and precedes the acquirement of a banking license as a rule. The British neobank Monese, which has a license to conduct transactions with electronic money instead of a banking license, operates similarly and works with a number of European banks that keep customers’ funds, thus making banks partners and not competitors.

- Neobanks created by traditional banks. Traditional banks that follow the pace of modern technologies and innovations are beginning to provide their services through neobanks. Kotak Mahindra Bank in India has launched its neobanking services as a new product in the form of 811 Digital Bank which acts separately [4].

In the fight against traditional banks, neobanks try to take over the part of the financial market where other banks failed or did not pay enough attention. Thus, the main target groups for neobanks are the following:

- First of all, the SMEs [5]. These enterprises have always lacked access to finance, and the SME-centric services of neobanks have aroused great interest. These banks offer affordable loans to small businesses with a simpler and faster approach to the lending process, unlike traditional banks,

- Customers not yet served by banks, including the younger generation,

- Migrants working in other countries,

- Freelancers.

It should also be noted that neobanks are taking special steps to increase financial literacy and financial involvement. Considering that the younger generation (up to 18 years old) is also a target for them and is considered as the primary target group for some neobanks, they post a lot of videos and useful materials to increase their platforms’ usage efficiency. From the customer’s point, the two types of banks mentioned above have many differences and similarities in terms of services, ways of delivery and other features, among which are:

| [6] | Neobank | Traditional bank |

| Credit card | Depending on the type | Yes |

| Maximum Deposit | Medium | High |

| Banking License | Depending on the type | Yes |

| Deposit Gguarantee | Depending on the bank | Yes |

| Branches | No | Yes |

| Face to Face Communication | No | Yes |

| Application | Yes | Depending on the bank |

| Characteristics | Agility | Stability |

| Target Market | SMEs, Younger Generation | Institutions, Large Businesses, General Public |

As we see from Table 1, neobanks largely provide the services provided by traditional banks, in some cases even with greater advantages. To thoroughly understand the differences between the latter, we will carry out a SWOT analysis.

| Neobank | Traditional Bank | |

| Strengths | – High speed

– Absence of expenses related to the maintenance of the bank’s branch network – Low commissions (some neobanks do not have commissions) – Simplicity and comfort – Presence of new digital tools to manage your own finances wisely – Ability to use the large network of ATMs without charge due to the cooperation with a large number of banks [7] – 24/7 access via advanced chatbots |

– Multichannel Cooperation with customers in offices and branches, as well as via digital tools (e-mail, SMS, application, website)

-Huge customer base (Philippon, 2016) – Trustworthy relations with the customers [8] – Variety of provided services and wide range of choice |

| Weaknesses | – Low level of trust

– One-way interaction with customers via digital tools – High costs for IT and online customer service – Narrow range of services (absence of car loans, mortgages, and other types of loans)[9]

|

– High administrative costs

-Additional costs for customer service in offices and branches – Length of making changes and taking decisions, and administration(bureaucracy) |

| Opportunity | – Introduction of new technologies and innovations

– Geographical expansion of online sales – Expansion of services through the involvement of new customers |

– Introduction of new technologies and innovations

– Opening additional offices in different regions to provide greater access |

| Threat | – Cyber risks

– Ease of the emergence of new neobanks, compared to traditional banks – Threats from being less regulated than traditional banks [8] – Profitability risk in the long run due to offering low costs for services to attract new customers [9] |

– Loss of market position

– Reduction of the customer base |

Table 2. Comparative SWOT analysis of neobanks and traditional banks

From the chart above, we can conclude that both sides have enough opportunities to gain competitive position in the market but neobanks surpass traditional banks with their development speed and they do not have the problem of bureaucracy hindering the latter. The existing weaknesses tend to be neutralised over time which can not be said about traditional banks operating in the same system for many years and making changes relatively slowly. The existing risks are more worrying from the point of view of neobanks because the long-term low profitability (despite a large number of customers, most neobanks are struggling for high profitability or generally normal economic profit) can push them out of the competition which can be partially prevented by increasing the customer base and thus expanding the existing threats of traditional banks. The low level of income can be explained by different factors. Firstly, digital banks offer only a subsystem of banking services which limits their profit potential. Then, despite their generally large customer base, most of them often use their accounts for transactions of secondary importance.

The role of neobanks in the financial system and their development trends

As neobanks are fundamentally changing the financial market, it is necessary to understand their influence and development dynamics which will distinctly show the image of the future financial system.

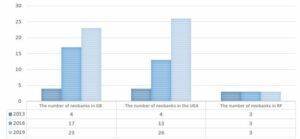

Chart 1. The number of neobanks in UK, USA and RF

We can see in Chart 1 that the number of fully digital banks has grown over the years in the financial centers of the world (USA, UK). Although the number of neobanks operating in Russia has remained the same, the latter have strengthened their position in the market and expanded the number of their customers. It should be noted that the total number of neobanks has increased almost 18 times during 6 years, reaching from 9 to 161 [13]. Meanwhile, the total number of traditional banks in the world is decreasing: 96 banks have recently closed in the United Kingdom, [14] and in the United States, compared to 2016, the number of traditional banks has decreased by 394, [15] and 1720 banks have closed in Europe since 2008 [16]. The decline in the number of banks has several causes, among which are the financial crisis that began in the 1980s, the resulting mergers of banks, the subsequent decline [17], as well as technological advancements – that by changing customer’s preferences and developing in form of credit and payment services [18]-pushes traditional banks to the structural changes.

Interestingly, the first neobanks were created in Great Britain. The Accenture’s Digital Banking Tracker in 2019 has revealed that the customer base of UK digital banks has reached 20 million, compared to 7.7 million in 2018[19], while the customer base of traditional banks is 13 million. The deposit volume of neobanks for each customer is 280 pound sterling, exceeding the volume of traditional banks. The latters’ average operating cost per customer (£ 170) is £ 120 higher than that of neobanks (£ 50). [20] Thus, by capturing market share, neo-banks impacted deposits and loan interest rates, offering more comfortable rates to their target [21]. This process began in 2016 when the lending assets of neobanks grew by 31.5%, with the decline of the Big Five (Barclays, HSBC, Lloyds Bank, Royal Bank of Scotland and Santander) with 4.9%, according to data received from KPMG [22]. At the same period, the Big Five expanded the Interest Rate Differential on three-year bonds, although all banks offered lower interest rates in January 2016, compared to the previous three years. This proves that neobanks also influence the investment market, as they offer both banking and investment products in one place/platform, making the customer’s experience more favourable. In addition, to attract new customers, the latter spare no effort to offer products at the most convenient interest rates.

Despite being an advocate of neobanks and fintech innovations in general, I have to state that neobanks have risks of losing their position and yielding in the fight with traditional banks in the future which should not be ignored. First of all, there is the issue of profitability addressed above- how long can neobanks provide services with their own funds or through fundraising, especially when in 2020, as a result of the pandemic, there is a decline in deposit interest rates [23]? Will the growing interest turn into trust and will customers switch entirely to these banks, saying goodbye to their traditional bank accounts? A number of similar questions can be clarified only over time, although the forecasts and data analysis (also considering the current trends) are of a positive nature.

As a result, we came to the conclusion that since the establishment of the neobanks, the growth trend is continuous, and the unprecedented progress will not stop in the near future. Nevertheless, there are many threats in the long run that can be prevented by taking steps now; these steps should be aimed at increasing the customer’s trust and turning the latter’s base into a profit.

However, the influence of neobanks on the banking system is undeniable because they have activated the market, expanded the financial involvement of the population, increased competition, and challenged traditional banks, introducing themselves to customers with new structures and business models.

References

[1] Neobanking 2.0: Global Deep Dive 2020 – Report By MEDICI

https://gomedici.com/neobanking-2-0-global-deep-dive-2020-report-by-medici

[2] Chappuis Halder (2015). “How can FinTechs and Financial Institutions work together?” Chappuis Halder, Co.

[3] https://www.revolut.com/en-LT/credit-cards

[4] https://teknospire.com/neo-banking-exclusive-digital-bank/

[5] https://psm7.com/mobilnye-banki/neobanki-i-klassicheskie-banki-bitva-titanov-ili-david-protiv-goliafa.html

[6] https://www.calendata.com/2019/05/ewallet-vs-neobank-vs-digitalbank.html

[7] https://www.fintechfactory.eu/post/disrupting-banking-how-neobanks-are-changing-the-financial-industry

[8] https://repositorio.ucp.pt/bitstream/10400.14/25884/1/Thesis_Sara_Santos_152416071.pdf

[9] https://www.pwc.in/consulting/financial-services/fintech/fintech-insights/neobanks-and-the-next-banking-revolution.html

[10] https://www.thebalance.com/what-is-a-neobank-and-should-you-try-one-4186468#:~:text=Neobanks%20are%20financial%20technology%20firms,sake%20of%20being%20cutting%2Dedge

[11] https://medium.com/datadriveninvestor/neobanking-is-the-future-of-banking-here-469148216d15

[12] The data was obtained from https://neobanks.app/ website, as well as from the websites of one and all neobanks․

[13] https://gomedici.com/neobanking-2-0-global-deep-dive-2020-report-by-medici

[14] List of Banks in the United Kingdom, https://thebanks.eu/banks-by-country/United-Kingdom

[15] https://www.statista.com/statistics/184536/number-of-fdic-insured-us-commercial-bank-institutions/?fbclid=IwAR1QeV4TVXQYdRiBJhr_su-4xSHk5VfAVhXwaJC4qbKTQtEcnIvPjaQTC2Q

[16] https://ec.europa.eu/eurostat/cache/digpub/european_economy/bloc-3d.html

[17]https://www.richmondfed.org/~/media/richmondfedorg/publications/research/economic_brief/2015/pdf/eb_15-03.pdf

[18] https://www.stlouisfed.org/on-the-economy/2018/february/why-banks-shuttering-branches

[19] https://www.uktech.news/news/uk-neobanks-near-20-million-customers-but-customer-and-deposit-growth-rates-slow-20200224

[20] https://newsroom.accenture.com/news/uk-digital-only-banks-on-track-to-triple-customers-to-35-million-in-the-next-12-months-finds-new-research-from-accenture.htm

[21] https://www.theadviser.com.au/breaking-news/40134-neobank-makes-second-home-loan-rate-cut

[22] https://assets.kpmg/content/dam/kpmg/pdf/2016/05/challenger-banking-report-2016.PDF

[23] https://www.forbes.com/sites/madhvimavadiya/2020/05/11/is-covid-19-being-used-a-scapegoat-for-neobanks-recent-sluggish-growth/#27d722121dbe

Bibliography

- Neobanking 2.0: Global Deep Dive 2020 – Report By MEDICI https://gomedici.com/neobanking-2-0-global-deep-dive-2020-report-by-medici

- Chappuis Halder (2015). “How can FinTechs and Financial Institutions work together?” Chappuis Halder, Co

- Необанки и классические банки: битва титанов или Давид против Голиафа?, Анастасия Шевченко, автор книги «Диджитал Эра», генеральный директор Lugera Ukraine, СЕО Fintech Solutions https://psm7.com/mobilnye-banki/neobanki-i-klassicheskie-banki-bitva-titanov-ili-david-protiv-goliafa.html

- Is COVID-19 Being Used As A Scapegoat For Neobanks’ Recent Sluggish Growth? https://www.forbes.com/sites/madhvimavadiya/2020/05/11/is-covid-19-being-used-a-scapegoat-for-neobanks-recent-sluggish-growth/#26e0b4341dbe

- A new landscape: Challenger banking report, KPMG, May 2018 https://assets.kpmg/content/dam/kpmg/pdf/2016/05/challenger-banking-report-2016.PDF

- Ewallet vs NeoBank vs DigitalBank https://www.calendata.com/2019/05/ewallet-vs-neobank-vs-digitalbank.html

- Traditional And Challenger Banks In Uk: Comparison In Terms Of Customer Value, Sara Santos, September 2018, p 6 https://repositorio.ucp.pt/bitstream/10400.14/25884/1/Thesis_Sara_Santos_152416071.pdf

- What Is a Neobank? Definition and Examples of a Neobank https://www.thebalance.com/what-is-a-neobank-and-should-you-try-one-4186468#:~:text=Non Banks%20are%20financial%20technology%20firms,sake%20of%20being%20cutting%2Dedge

- Neobanks and the next banking revolution, Vivek Belgavi, Partner, Financial Services – Technology and FinTech Leader, PwC India https://www.pwc.in/consulting/financial-services/fintech/fintech-insights/neobanks-and-the-next-banking-revolution.html

- NeoBanking: Is the future of Banking here? Written By Keshav Bagri, Venture Capital https://medium.com/datadriveninvestor/neobanking-is-the-future-of-banking-here-469148216d15

- List of Banks in the United Kingdom https://thebanks.eu/banks-by-country/United-Kingdom

- Disrupting Banking: How Neobanks are Changing the Financial Industry, Author: Špela Mihelin https://www.fintechfactory.eu/post/disrupting-banking-how-neobanks-are-changing-the-financial-industry

- Number of FDIC-insured commercial banks in the United States from 2002 to 2018 https://www.statista.com/statistics/184536/number-of-fdic-insured-us-commercial-bank-institutions/?fbclid=IwAR1QeV4TVXQYdRiBJhr_su-4xSHk5VfAVhXwaJC4qbKTQtEcnIvPjaQTC2Q

- The European economy since the start of the millennium, The statistical office of the European Union https://ec.europa.eu/eurostat/cache/digpub/european_economy/bloc-3d.html

- Explaining the Decline in the Number of Banks since the Great Recession By Roisin McCord, Edward Simpson Prescott, and Tim Sablik, Federal Reserve Bank Of Richmond, March 2015, p. 2 https://www.richmondfed.org/~/media/richmondfedorg/publications/research/economic_brief/2015/pdf/eb_15-03.pdf

- Why Are Banks Shuttering Branches? February, 2018 https://www.stlouisfed.org/on-the-economy/2018/february/why-banks-shuttering-branches

- https://www.uktech.news/news/uk-neobanks-near-20-million-customers-but-customer-and-deposit-growth-rates-slow-20200224

- K. Digital-Only Banks on Track to Triple Customers to 35 Million in the Next 12 Months, Finds New Research From Accenture, Petra Shuttlewood, Accenture https://newsroom.accenture.com/news/uk-digital-only-banks-on-track-to-triple-customers-to-35-million-in-the-next-12-months-finds-new-research-from-accenture.htm

- Neobank makes second home loan rate cut https://www.theadviser.com.au/breaking-news/40134-neobank-makes-second-home-loan-rate-cut

- A new landscape: Challenger banking report, KPMG, May 2018 https://assets.kpmg/content/dam/kpmg/pdf/2016/05/challenger-banking-report-2016.PDF

- Neo Banking – An exclusive Digital Bank https://teknospire.com/neo-banking-exclusive-digital-bank/

- What Are Neobanks and What Do They Mean for SMEs? https://www.scottishpacific.com/news-articles/what-are-neobanks-and-what-do-they-mean-for-smes/

- https://www.revolut.com/en-LT/credit-cards

- Neobanks struggle to turn popularity into profit https://www.consultancy.uk/news/24070/neobanks-struggle-to-turn-popularity-into-profit

- The Profitability Challenge for Challenger Banks https://fincog.nl/blog/15/the-profitability-challenge-for-challenger-banks

Author: Hermine Fanyan © All rights reserved.

Translator: Mariam Antikian.