Preliminary Overview

Among several sources of finance, bonds have been an essential, reliable, cost-effective source of financing for both public funds and enterprises over the world for decades. The year 2008 and subsequent events emphasized their importance of the latter for the welfare of the real sector of economy. [1] The overall size of the global bond market in 2019 exceeds $ 115 trillion [2], while the bond market of the Republic of Armenia (RA compounds $ 1.8 billion [3] (1.5% of the global market). The question then arises as to what are the reasons for the small sizes, and whether the market is declining or developing. The purpose of this work is to assess the current state of the RA bond market, to find out the factors affecting it, as well as to discuss the development prospects.

The current state of the RA bond market

In general, the bond market represents a part of the investment market where commercial organizations and governments issue debt securities and distribute them in the primary market to raise capital. As a rule, the proceeds from government bonds (GB) are directed to infrastructural improvements , as well as to pay down government debt. [4]

From the investor’s point of view, government bonds (GB) are assumed to be safer, as they have a lower risk than corporate bonds (CB), which, however, in the short run, determines the latter’s low profitability. From this perspective, RA GBs are considered highly liquid: investments in the GB market exceed the bond investments by transaction volumes.

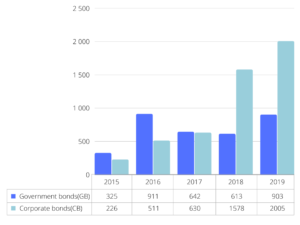

The above-noted chart shows that until 2017, government bond’s transactions had a growth rate and exceeded corporate bond transactions, but in the last two years, CB transactions were twice as high as GBs. However, the picture will be complete when we pay attention to the transaction volume. Thus, the trading volume of GB in 2018 and 2019 was respectively 26 billion and 29 billion more than the trading volume of CB. It shows that the GB market in Armenia is more liquid in the long run due to low risk and high profitability. It should be noted that in 2018, the number of CB transactions increased sharply due to the new dollar bonds issued by several banks (Ameriabank, Ararat Bank).

The liquidity of bonds in the RA is dependent on the policy pursued by the Ministry of Finance and the Central Bank. Due to the purchase and sale of GBs by the Central Bank and the redemption of GBs by the Ministry of Finance, the market becomes more active, the liquidity improves, and the interest in the bonds, subject to repurchase, rises among investors. [5] The volume of redemption by the RA Ministry of Finance amounted to 28.18 billion drams in 2019. [6]

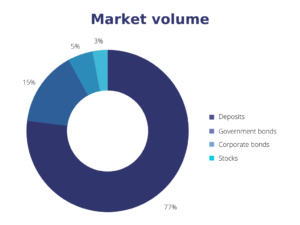

The RA bond market is still in the development stage, unlike deposits. So, if we study the investment directions of free funds circulating in our country, we will have the following picture:

The above chart illustrates that individuals and legal entities in the Republic of Armenia prefer to invest their free funds mainly in banks in the form of deposits (77%) and then invest in government bonds (15%). If we follow the dynamics, the volume of the GB market increased by 15.79% compared to the previous year, while the growth in the volume of deposits was 28.34%, which indicates there has been an increase in total investment. Hence, we can conclude that there are some issues in the bond market, which hinder market activation.

In the framework of the analysis of development prospects of the bond market, we will assess the connection between corporate and government bonds and several factors. The first factor is the real wage, which, being the primary source of savings, is invested in corporate and government bonds by 3-4%. Thus, the correlation between the real wage and the transaction volume of corporate and government bonds compounded 0.16 and 0.72, respectively. [8] [9] The Pearson correlation coefficient (r)indicates the linear correlation between the two variables and is in the range of[-1; 1] (the closer to 1, the stronger the correlation, and vice versa). Thus, we can conclude that there is a weak relation between the real wage and corporate bonds and investments do not depend on real wages. Here, it can be noticed that the large portion of investments in CBs are made by legal entities rather than individuals, which may be the reason for the weak correlation. Meanwhile, there is a significant correlation between GBs and real wages, and a rise in real wages may lead to an increase in GB transactions.

To identify the factors influencing the investment structure, it is important to assess the correlation between economic growth and changes in the placement of government bonds. Thus, there is a -0.86 correlation between the latter, which means that they have the reverse effect on each other: an increase in economic growth may lead to a reduction of the placement volumes of GBs, as public expenditure may be financed from other sources.

It is important to highlight that that inflation has decreased during the last three years, taking into account the economic changes in the country (the post-revolutionary period). As inflation is included in the calculation of the real yield of bonds, it is necessary to understand its impact on the latter. Thus, the findings of the analysis reveal that inflation also has the reverse effect on the government and corporate bonds yield. The correlation between inflation and the latter is -0.44 and -0.07, respectively, which proves the impact of inflation on the bonds yield and emphasizes the role of the Central Bank in controlling inflation.

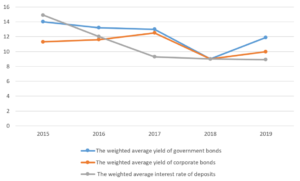

Referring to the deposits, it is interesting that the latter’s weighted average interest rate is lower than that of the bonds; in contrast to the bonds, it has a downward trend (Figure 3). However, taking into account the high level of trust in banks, a significant part of savings in Armenia (77%) turns into deposits. The predominance of deposits over bonds is explained by the relatively high level of financial literacy in the deposit market, with the availability of digital tools that make deposit acquisition simpler and faster, as well as by the role of the Deposit Guarantee Fund of Armenia. Here, however, it can be noted that according to the RA Tax Code, 10% income tax is applied to the interest income from deposits. Meanwhile, return on investment of government bonds has been exempt from income tax for a long time and the corporate bonds since March 2020. It was a significant step to stimulate investment in the financial market, especially given that the household saving ratio has decreased to 9.1% since 2015 (17.5%) in Armenia. [10]

And finally, if we assess the existing correlation between the loans and the placement volume of government and corporate bonds, taking into account their role in activating cash flows, business operations, and indirectly increasing their funds, we can see that the correlation between them is 0.10 and 0.68, respectively. Thus, we can conclude that the access of finance has an impact on investments in corporate bonds and can contribute to their promotion.

Thus, we can conclude that the investment volume in the Republic of Armenia has increased significantly: the majority of it has been invested in banks in the form of deposits, and then in government bonds. The RA bond market has developed in line with the growth of investment volumes but continues to lag behind the deposits. As a result, it has become crystal clear that the change in real wages directly influences the volume of government bonds; and its increase can have a positive impact on market activation. Moreover, inflation, being closely related to the change in real wages, has the reverse effect on the yield of government and corporate bonds, so its normal level is one of the means of stimulating the market. The role of access to finance is also essential, as its high level has a positive effect on increasing investments in corporate bonds.

Thus, although the Armenian bond market has grown in recent years due to policy pursued by the Ministry of Finance and the Central Bank, transaction volume is small compared to deposits, as:

- There is a problem of financial literacy in this area, so clear steps must be taken in that direction: in particular, to make financial literacy as a part of the curriculum in higher education institutions, regardless of profession. As, studies show that , organizations are more financially involved in Armenia, , the financial inclusion and consequently, financial literacy of employees can be promoted, with the support of them .

- Although the investment volume has increased over the years, most of the latter is directed to deposits, and the high transaction volume in bonds indicates that they are mainly carried out by legal entities. From this perspective, market activation can be ensured by promoting the participation of individuals. Here the emphasis can be on companies that issue bonds, offering employees more favorable conditions than the market, or to introduce a bonus system by offering bonds for respective work. As banks are more active in the bond market in Armenia, their role is essential in terms of bond sales. It is proposed to actively offer the bonds issued by banks along with their other financial products so that there is activity and growth in this market in the long run.

- Moreover, given the fact that the introduction of digital technologies by banks and simplification of the deposit acquisition process also have a positive effect on increasing the volume of deposits, it is assumed that the simplification of bond purchases and the introduction of a digital system can activate the market, too. Therefore, it is necessary to completely digitize the procedure of purchasing both government and corporate bonds.

Bibliography

Author: Hermine Fanyan © All rights reserved.

Translator: Armine Tatoyan