A quarter of the EU energy consumption is supplied through natural gas, that’s why many EU countries mostly depend on gas imports. In general, the European Union imports half of the used energy resources. The dependency of the import is bigger on oil (90%) and natural gas (66%) imports, and lesser on solid fuel (42%) and nuclear fuel (40%) imports. Research shows that at least by 2030 Europe will be dependent on energy imports by 70%, given that the EU isn’t yet able to suggest an essential alternative that can reduce such energetic dependency[1].

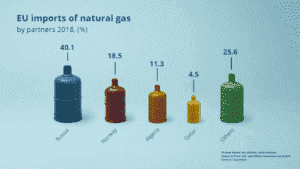

The import of necessary natural gas supplies to the EU is completed through 4 main supplier countries: Russian Federation (main supplier (47%)), Norway (34%), Algeria (11.3%), and Qatar (4.5%). Bulgaria, Czech Republic, Estonia, Hungary, Latvia, Poland, Romania, and Slovakia get 75-100% of natural gas import from Russia. The first 6 of these countries also get 50% of oil imports from Russia [2]. Russian natural gas is supplied to the EU in 5 main directions. Over 89% of gas supplies are delivered to the EU by pipelines, the rest is transported by ship as LNG. The advantage of the supply by pipelines is that it is more accessible in comparison to the supply of LNG conditioned by transportation and other expenses. However, the main disadvantage is that the pipelines, as a rule, pass through areas of a few countries, making the EU dependent on transit countries. . The main direction of supply is Ukraine (Brotherhood pipeline and Balkan stream) which included almost half of the whole volume of import from Russia. It is followed by Belarus (“Yamal” pipeline) which covers about 20% of the natural gas supply. The 2 new pipelines, “Nord Stream 1” (30%) (since 2011) and Turk Stream (since 2020) directly connect Russia to Germany and through Europe, by Turkish area [3].

Nowadays, the construction of another pipeline, “Nord Stream 2” is going in Germany which was intended to launch in the first quarter of 2021. All the 3 directions are expected not to be affected because of geopolitical transit questions.

Russia is one of the cheapest suppliers of natural gas, therefore the impulses of replacing it with another source are almost unreal[4]. The members of NATO (Germany, Italy or France) which have big solvency have been able to realize their market potential and get discounts and guarantees from Russia. The purposes of the EU should obviously be first, getting accessible energy supplies without a strong dependency on Russia and secondly, having a reserve option.

The strongest tool of the allies is the transparency of the energy commerce and EU market rules for the fight against the abuse of monopoly power by the suppliers. Russian suppliers often use the asymmetry existing between the EU countries to suggest better conditions to their main partner Germany than to the Czech Republic or Bulgaria, the economically conceding countries[5].

The European Commission, the EU executive should investigate such cases. This regulatory, independent function protects from consequences caused by Russia’s divisive policy[6]. However, it’s not always that the EU uniformly uses the rules of its market. Particularly, in 2018, the commission did not fine “Gazprom”, Russia’s energy giant, although it had a discriminatory attitude towards Central Europe, for the benefit of Germany [7].

The growing dependency of the EUon energy suppliers, particularly on Russia led to the development of the new strategy, the purpose of which is to diversify the sources of their supplies. The consequences of European energy dependency haven’t been limited only by the threat of energy security situation, but also have been expanded, disrupting the European foreign policy as integrity, and that led to a pan-European tendency to avoid sharp political disagreements with the Russian side because they can affect the volumes of their energy supply.

Especially, numerous factors that have political character are obvious which promote or prevent the stability of EU natural gas supply.

Particularly,

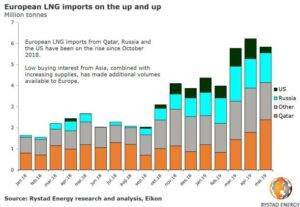

- The competition pace between international 2 big states, the USA and Russia, on the supply of energy resources (especially LNG) to Europe.

In July 2018, Trump, the USA president, and Jan-Claude Juncker, already the former president of the European Commission announced the expansion of export volumes of LNG to the EU. Since then, the USA has become the third-largest supplier of LNG in Europe. In 2019, the USA LNG suppliers signed long-term commerce agreements with Spain (5Mtpa) [8] and Poland (1.5+Mtpa)[9].

What comes to Russian Federation, taking into consideration “Gazprom” ‘s technical imperfection about developing export abilities Russia decided to let other companies export LNG besides “Gazprom” keeping the monopoly of pipeline natural gas export constant[10].

- Political stability or instability in transit countries

The EU gets 30% of energy resources from Russia through the area of Ukraine. Therefore, the disagreements between Russia’s and Ukraine’s governments which “are encouraged” by the USA, promote the development of a politically unstable situation, negatively affecting all the energy supply and therefore also the further process of gas supply. Therefore, it’s primary for Europe to have a relatively stable political atmosphere in Ukraine and Russia. Vivid evidence, to what we mentioned, is the open letter to the European leaders signed by Russian President Vladimir Putin announcing that Europe confronts a new growing risk of a crisis of natural gas supply because of Ukrainian conflicts (Umbakh, 2014).

In 2007, the EU undertook an ambitious way of transforming energy. The Union wants to drastically reduce the CO2 emission mostly replacing fossil fuels with clean energy. Besides climate change, the main cause of looking for new energy sources is the pure economic statement: every year, the EU spends about $445 billion for importing energy resources[11].

But the import dependency is the only factor in providing gas security. The second issue of European gas security is the composition of demand. In winter (October-March), the consumption of natural gas in the EU is almost double that of in summer (April-September)[12]. The majority of this additional demand is required for heating buildings and is considered the primary determinant of natural gas infrastructure size and utilization. For providing the prevention from possible obstruction of supply or the destruction of it when emerged, the EU legislation creates general standards and indicators for measuring the serious threats and defining how much natural gas is needed to import for appropriately reacting to the seasonal changes of the demand.

Talking about the possible risks of EU gas security, we should not forget the new challenge of the international economy, the COVID-19 pandemic, which also can be considered a new possible security risk. It has twice a negative effect on the transition of Russian natural gas from Russia to the EU. Firstly, conditioned by the pandemic the construction of Nord Stream 2 is being procrastinated. Thus, the changes in its operation dates are possible. The problem is that the construction of this pipeline is financed by Gazprom and the oil-gas deflation reduces the opportunity of financing (between January and February, in 2020, the price of export of Russian natural gas has decreased by 45% by a dollar in comparison to last year’s same period [13]). Taking into consideration the fact that the new pipeline could facilitate gas supply to the EU in case of conflicts in transit, procrastination of its construction might be risky for the EU natural gas security.

Besides, conditioned by the pandemic the fall of the natural gas demand can negatively affect the use of the Russia-EU natural gas route due to the agreements signed by Russia and countries in transit. Particularly, Russia and Ukraine signed agreements for the next 5 years by which is planned that despite the dimension of the natural gas supply, Russia is obliged to pay Ukraine for providing a natural gas transition to the EU in return. This agreement was considered as EU diplomatic success taking into account the Russia-Ukraine geopolitical difficult connection and the possible security risk coming from it from the perspective of the EU energy supply. Conditioned by the pandemic, the little use of this route is already becoming expensive for Russia.

Thus, the security risks in the EU are mainly conditioned by the supply structure. The Russian factor is essential here. With regard to risks, it is different from other suppliers as a nuclear country and all the allies should be afraid of its economic collapse. What concerns the supply diversification as a security guarantee, we can mention that the dimension growth of the LNG supply and the suppliers’ diversification is promising from the perspective of neutralizing the risks.

At the same time, it’s impossible to state uniformly that the EU has been able to overcome the risks connected to natural gas security, perhaps conditioned by the Russia-US conflict about LNG supply, possible crises, price fluctuation, etc. These are factors and the prediction of their definite period of time of the effect or the route is essentially difficult but their display can be a serious security problem not only for the EU but also for the international economic factors.

We can prove that the solution of the problems and the neutralization of the risks mentioned above or their reduction are possible to provide only due to united efforts with all the EU countries because first of all, together efforts assume implementation of fewer expenses by the level of one country which is profitable for the EU countries who have weaker economies. Besides, mutually agreed, effective steps will raise the EU’s reputation as a politically succeeded institution. The steps which were possible in the conditions of geopolitical conflicts the EU carried out for neutralizing the possible risks of the natural gas security, had and will have their results in future and the best proof of it was the agreement between Russia and Ukraine over the gas transition and also the construction of Nord Stream-2 natural gas pipeline.

[1] “EU Imports of Energy Products—Recent Developments,” Eurostat, October 2018, accessed May 30, 2019, https://ec.europa.eu/eurostat/statisticsexplained/index.php/EU_imports_of_energy_products_-_recent_developmentsReferences

[2]https://www.igu.org/sites/default/files/nodedocumentfield_file/IGU_Wholesale%20Gas%20Price%20Survey%202018%20Final.pdf

[3] “BP Statistical Review—2019: Russia’s Energy Market in 2018,” BP, accessed September 9, 2019, https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2019-russia-insights.pdf

[4]“EU Should Work on Becoming a Single Gas Buyer—Sefcovic,” Reuters, November 17, 2014, https://af.reuters.com/article/commoditiesNews/idAFL6N0T71YO20141117, https://www.weforum.org/agenda/2016/05/which-economies-are-most-reliant-on-oil/

[5] https://ec.europa.eu/competition/antitrust/cases/dec_docs/39816/39816_10148_3.pdf

[6] “Clean Energy for All Europeans—Unlocking Europe’s Growth Potential,” European Commission, November 30, 2016, http://europa.eu/rapid/press-release_IP-16-4009_en.htm

[7] Rochelle Toplensky, “Russia’s Gazprom Dodges Fine in EU Antitrust Settlement,” Financial Times, May 24, 2018, https://www.ft.com/content/02a15d08-5f3f-11e8-9334-2218e7146b04

[8]https://www.natlawreview.com/article/lng-europe-current-trends-european-lng-landscape-and-country-focus

[9]https://www.reuters.com/article/usa-poland-lng/polands-pgnig-to-buy-more-lng-from-us-company-venture-global-idUSL2N23J0MZ

[10]https://www.ft.com/content/b6c8cf9c-f1f8-11e1-bba3-00144feabdc0

[11] https://ec.europa.eu/energy/topics/energy-security/secure-gas-supplies_en

[12] https://www.iea.org/commentaries/a-long-term-view-of-natural-gas-security-in-the-european-union

[13] Gustav Gressel, “Negative Energy: Berlin’s Trumpian Turn on Nord Stream 2,” European Council on Foreign Relations,2019, https://www.ecfr.eu/article/commentary_negative_energy_berlins_trumpian_turn_on_nord_stream_2

Bibliography

Author: Narine Petrosyan © All rights reserved.

Translator: Jemma Khachatryan.